Mutual Funds >> Arbitrage Funds

Arbitrage is the simultaneous purchase and sale of an asset in order to profit from a difference in the price. This usually takes place on different exchanges or marketplaces. It is also known as a "riskless profit".

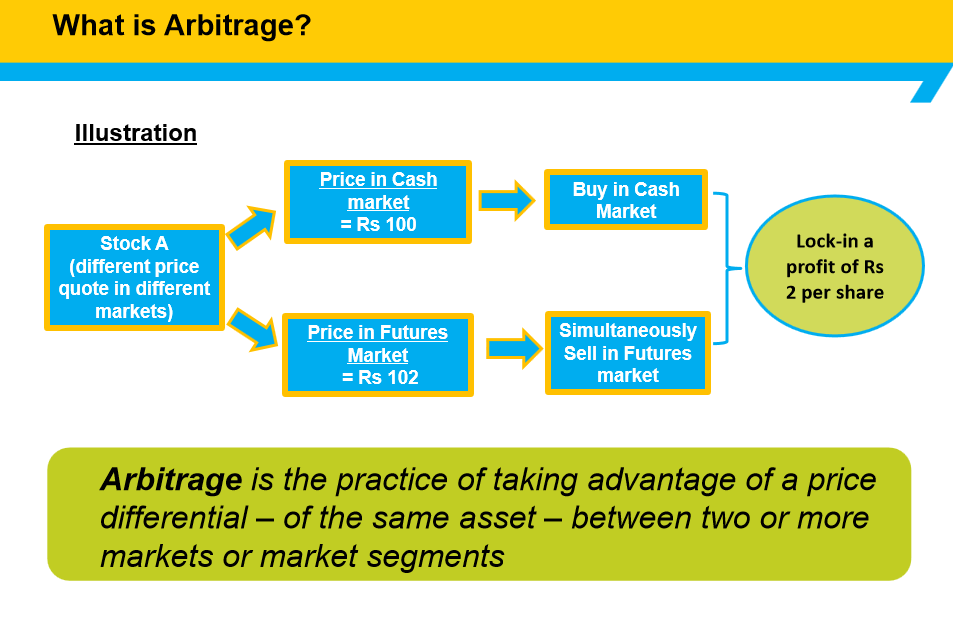

Arbitrage takes advantage of the "mis-pricing" of securities or a price difference between two or more markets.

Deterministic arbitrage takes advantage of price differences for the same (or similar) assets on different markets. When such price discrepancies exist it is possible to sell short the asset that is overpriced on one market and buy the under-priced asset on the other market. Assuming their prices converge to a correct and equal value, the arbitrageur has earned a profit without any risk.

It is important to note that arbitrage is DIFFERENT from least cost pricing. A situation can only be considered for arbitrage if there exists a way for riskless positive cash flows in the current period through a manipulation of long/short positions. Relative risk arbitrage and bargain hunting are trading strategies, but they are NOT riskless and thus are not true arbitrage opportunities. Arbitrageurs trade on speculation (often with background research) but the nature of their financial transactions should not be confused with technical, or statistical arbitrage, which is a mathematical imbalance that creates opportunity for riskless cash inflows.

PASSION | CULTURE | ETHICS

PASSION | CULTURE | ETHICS